Automate. Scale. Convert. Thrive.

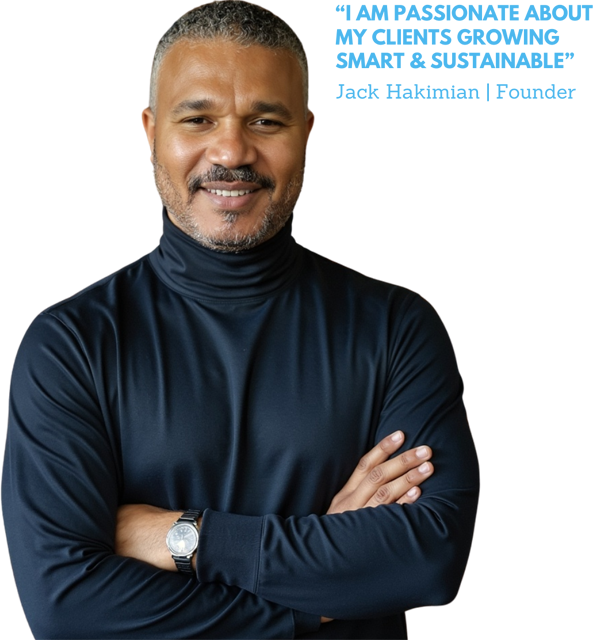

Jack Hakimian and the Global Presence team craft high-performance WordPress sites, AI agents, chatbots, automation, software, and digital marketing—intelligent systems that think, adapt, and scale. We design digital ecosystems that convert vision into powerful, lasting growth.

BLOG & NEWS

AI-EMPOWERED MARKETING SERVICES

PROUD MEMBERS

CERTIFICATIONS & EXPERTISE

GOOGLE REVIEWS

Jack and his team do a good job on our website. They respond quickly to work requests and keep us informed of progress. | View Review

I had a really great experience. Mr.Hakimian is very knowledgeable, informative, patient and explained every single point thoroughly. They are very professional. They always respond fast. They are absolutely distinguished from the other marketing companies that I approached before. I definitely recommend them to anybody who would like to start and expand their business. Keep up the good work. | View Review

My experience with Global Presence has been one of complete satisfaction. Not only does the website created by Global Presence looks amazing and their marketing ideas has provided Trinity Water Damage Restoration Service with the positive exposure needed. Global Presence has made a difference and i would recommend them to any business looking for creative ways to grow. Thank you Global Presence | View Review